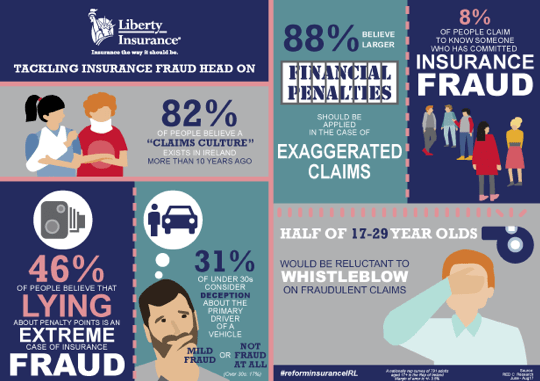

The issue of insurance fraud and the growing “claims culture” has become a hot topic for not just the thousands of Irish people with health, car and house insurance but for the insurers themselves. Now new research from Red C Research on behalf of Liberty Insurance suggests a serious discrepancy in what constitutes insurance fraud between 17- to 29-year-old drivers and their older peers. The research surveyed approximately 750 drivers and found that younger drivers are ‘more fluid’ in their interpretation of insurance fraud compared to older drivers. The research showed 31% of young drivers considering being untruthful about the primary driver of their car to be ‘mild’ insurance fraud or not fraud at all; this compares to 19% of all adult drivers.

Additionally, 56% of young drivers consider being untruthful about your profession to be mild insurance fraud or not fraud at all, and 58% say the same about providing a false estimate of the number of kilometres driven per year. Despite these discrepancies, almost half, 46%, of all respondents said that being untruthful with your insurer about the number of penalty points on your license constitutes ‘extreme fraud’. 43% say providing your insurer with false information about your driving experience is also extreme fraud.

Consequences

In such cases, being untruthful about the primary driver, your profession, annual mileage or penalty points when applying for insurance constitutes fraud. If detected it may prevent an individual from securing insurance cover in the future or invalidate a claim.

Claims culture on the rise

82% of Irish drivers believe a ‘claims culture’ is more prevalent in Ireland today versus ten years ago, while 88% think those who submit fraudulent claims should face harsher penalties. Despite this, few are willing to blow the whistle on insurance fraud. 44% would not out of fear of being found out, increasing to 51% among those aged 25-34.

Commenting on the research, Liberty Insurance CEO, Sharon O’Brien, said:

“Ultimately, intentionally misleading your insurer about your driving record, your vehicle and other details on a policy application is a form of fraud. Fraud is a very serious problem for our industry and impacts significantly on cost. It is not a victimless crime and effects the premiums that our customers pay.

“Most Irish people recognise this and want to see these people face harsher penalties. The rapid rise of premiums in Ireland is of course not sustainable, and that’s why Liberty Insurance is hosting today’s event: we want to work with industry stakeholders and the Government to agree the best ways to combat fraud and make motor insurance in Ireland as fair and affordable as possible.

“Additionally customers need to understand the importance of checking the details on their documents are correct and that their circumstances have not changed so that they are not unintentionally misleading their insurer”.

The research was published in advance of Liberty Insurance’s Driving Motor Insurance Reform stakeholder event being hosted in Dublin today (26 September). The event will bring together leading Irish and international motor insurance experts to debate the challenges and actions required to successfully deliver motor insurance reform.

Find out more about their Driving Motor Insurance Reform or get a car insurance quote in as little as two minutes.