Stocks and shares are just so over.* These days, savvy savers are going alternative. So-called “passion” investments, such as fine wine, art and vintage watches, are where it’s at if you want a faster return on your cash. You can also carry your investment around with you – far from being a mere statement accessory, a number of designer handbags are more lucrative than investing in the stock market. Take the Hermes Birkin – the iconic tote has increased in value by an average 14.2 per cent each year since its launch in 1981, making it a safer bet than gold.**

Good news for wine buffs, too – fine wine saw a 24 per cent increase in value in 2016 alone (FYI, it’s all about north Italian vintages right now) ***. And coin collectors are laughing all the way to the bank – in September 2015, a 1839 Queen Victoria proof set sold for €596,608 double the previous record.****

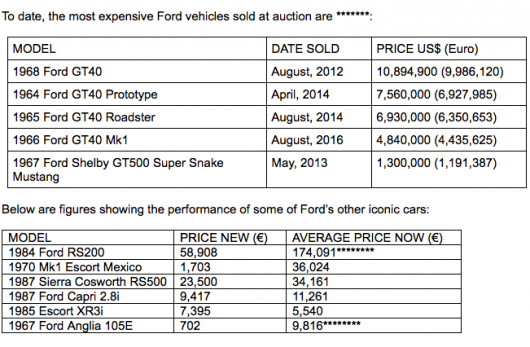

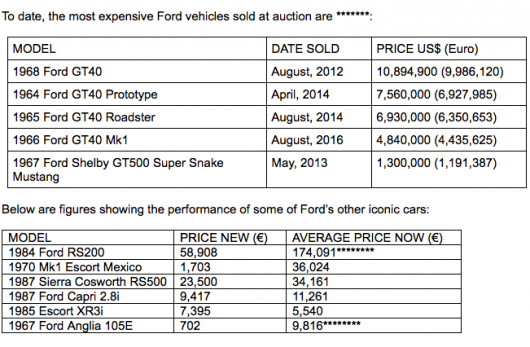

For those who think there’s no money to be made from cars, think again – total growth over the past decade was 457 per cent***. This is a bigger increase than even property, which have increased in value on average 20 per cent in the last decade and 152 per cent since 2000 across Europe*****. And it’s not just super-cars commanding a hefty price tag. Among the list of top investor car makes, Ford offers among the lowest entry costs.

“The legendary Ford GT40 supercar accounts for the lion’s share of the most expensive Fords ever to be sold at auction and the new Ford GT, which is being delivered to customers right now, will be our most exclusive car ever – limited to volumes of no more than 250 per year globally,” said Jim Farley, executive vice president and president, Europe, Middle East and Africa, Ford Motor Company, who is a passionate racer and collector, and counts a GT40 in his private collection. “But more attainable classic hot hatches are showing impressive gains – providing they are in good condition.”

In March 2016, a Ford Escort Cosworth with less than 2,500 miles on the clock sold at auction for €80,001 after first going on sale for €26,102 in 1992. The average price of a Cosworth is now more than double that original price and the Fiesta XR2, which went on sale in 1981 for €6,505, has trebled in value since 2014 to an average sale price of €10,701.****** There are also stories of sporting Ford vehicles exchanging hands in private for higher sums than are made public.

“Before you decide where to put your money, think carefully about the right investment for you,” said Andrew Shirley, who compiles the Knight Frank Luxury Investment Index: “Although the indices that track asset classes like classic cars have seen very strong growth over the past 10 years, potential investors need to be cautious. Not every car will have seen its value grow by the same amount. There are also significant costs associated with the ownership of luxury investments, such as storage, maintenance and insurance. My advice is to always buy something that you love and will enjoy owning. Any increase in value should be seen as a bonus.”

One rationale for the huge increase in classic car values is that profits from sales by an individual are exempt from tax in countries across Europe. However, for many collectors it’s the realisation of a childhood dream to buy a car they always longed for.

“I’ve always enjoyed Capris since I was 18 years old and had a Daytona Yellow GXL with black vinyl roof “ said John Pepper, a 56-year old collector from Essex who currently has around 18 Capris in various states of repair. “I think I was put on this earth to find as many as I could and put them back on the road. I know they’ve gone up in value, but that’s not the point, I just like playing with them and talking about them, it’s in my blood.”

To date, the most expensive Ford vehicles sold at auction are: